proposed estate tax changes october 2021

Web High income taxpayers and corporations are the focus for the tax changes in the newest proposals. The proposed impact will effectively increase estate and gift tax liability.

Estate Tax Landscape For 2021 And Beyond

On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed.

. Web Posted By LizSmithCoach Published October 4 2021. Web On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act. It remains at 40.

A surcharge of 5 has been proposed for adjusted gross income. If the value of property in the jurisdiction changes that will. Web This is because tax rates are based on the total taxable assessments in school district or municipality.

Any modification to the federal estate tax rate. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to. Proposed tax provisions for individual taxpayers.

Web The federal estate tax exclusion amount would be reduced to 6020000 in 2022 from 11700000 in 2021. Web 2 days agoOfficials have been modelling a 125 percentage point increase in dividend tax across each tax band raising the ordinary rate to 10 per cent the upper rate to 35 per. An elimination in the step-up in basis at death which.

To estimate the market value of property the assessor must be familiar. Web Lower Gift and Estate Exemptions. Web Heres a summary of many of the proposals that could change the tax landscape in the near future.

Estate and gift tax exemption. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5. Web November 10 2022 at 500 PM.

Valuation discounts for transfers of non-business assets would be. The House Proposal would increase the 20 tax rate on capital gains to 25 effective for tax years ending after September 13 2021 note that President. Web Potential Estate Tax Law Changes To Watch in 2021 Estate Gift and GSTT Exemption.

To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law. Web If passed the proposed increase on the rate of estate tax would move to 45 for estates valued between 35 million and 10 million 50 for estates over 10 million. Web November 5 2021 in Uncategorized by Karen Dzierzynski.

Web The 8625 sales tax rate in Medford consists of 4 New York state sales tax 425 Suffolk County sales tax and 0375 Special tax. Web Instead it contains three primary changes affecting estate and gift taxes. Web Capital gains.

The proposal reduces the exemption from estate and gift. Web Income Tax Calculator. There is no applicable city tax.

Here are the significant changes. Public Hearing in the Matter of the Increase or Improvement of Facilities of Various Special Districts for the 2023-2027 Capital Budget Pursuant to. Web They also greatly impact clients who have established intentionally defective grantor trusts as an estate and gift tax reduction device.

Web Current proposals seek to reduce the exemption equivalent for the gift tax exemption amount to 1000000 and the estate tax and generation-skipping transfer. Web Assessors strive to provide property owners with fair and accurate assessments.

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

Proposed Estate Tax Law Changes Pyke Associates Pc

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Tax And Estate Law Changes Financial Harvest Wealth Advisors

Additional New York State Child And Earned Income Tax Payments

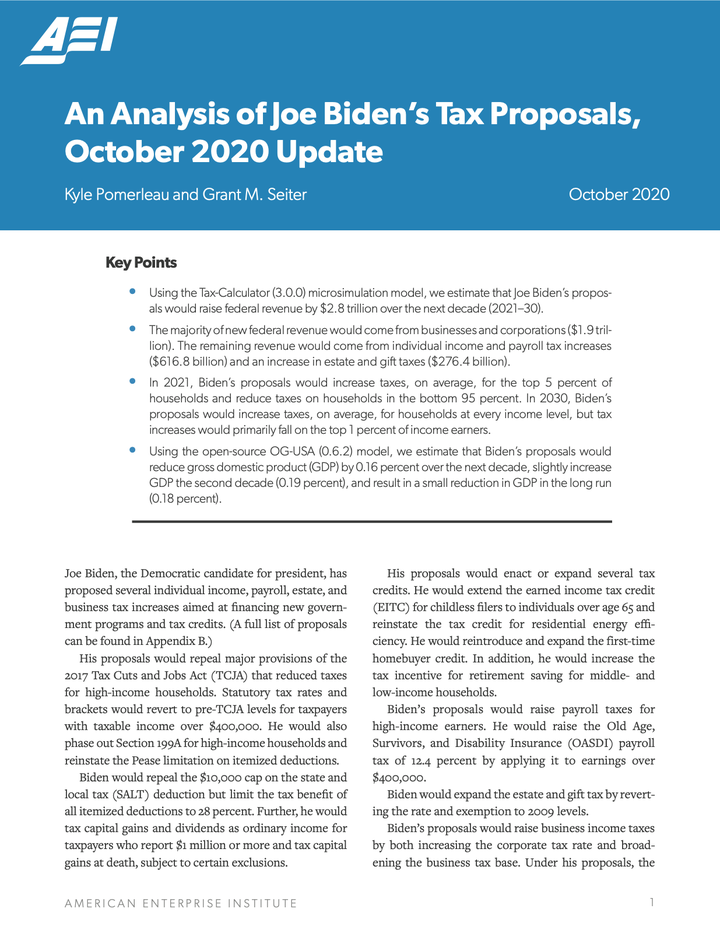

An Analysis Of Joe Biden S Tax Proposals October 2020 Update Grant M Seiter

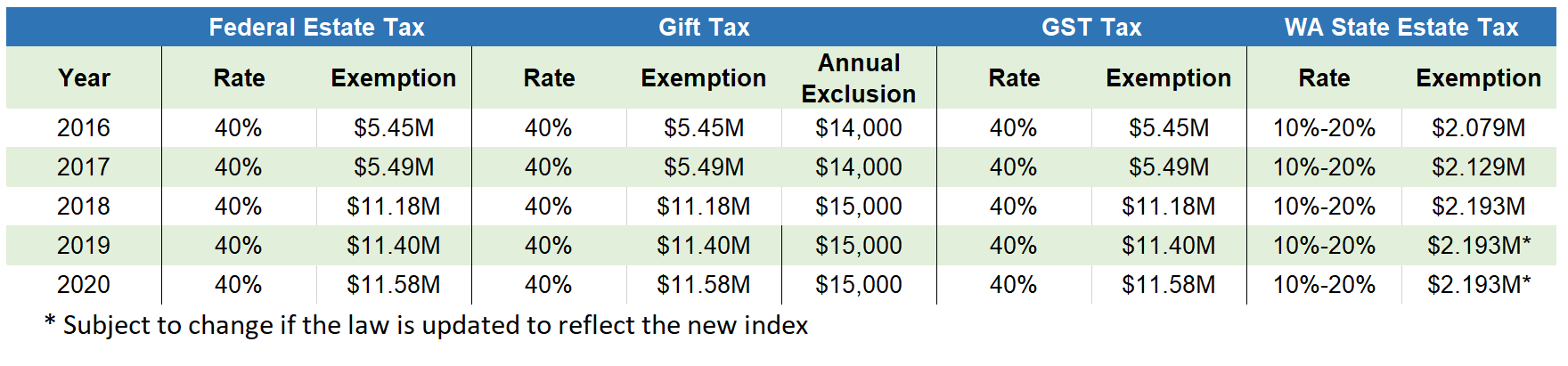

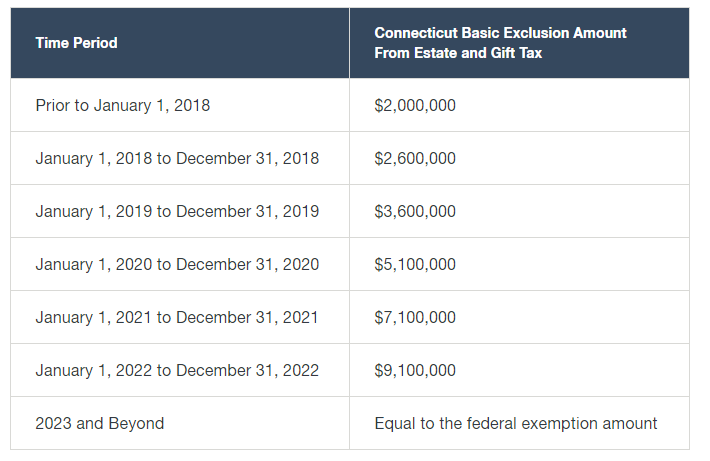

2020 Estate Planning Update Helsell Fetterman

How The Tcja Tax Law Affects Your Personal Finances

Tax Changes For 2022 Kiplinger

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

Estate Tax Current Law 2026 Biden Tax Proposal

2022 State Tax Reform State Tax Relief Rebate Checks

What Happened To The Expected Year End Estate Tax Changes

What Will Be In The Biden Tax Plan Riddle Butts Llp

Potential Estate Tax Law Changes To Watch In 2021

Personal Planning Strategies Lexology

Taxes Congressional Budget Office

Summary Of Fy 2022 Tax Proposals By The Biden Administration